App For Money Before Payday: Your Ultimate Financial Survival Guide

Ever found yourself stuck between paydays, wondering how to make ends meet? Well, you're not alone, my friend. Millions of people around the world face this challenge, and guess what? Technology has got your back! There are now plenty of apps for money before payday that can help you get through tough times without breaking a sweat. Whether you need cash fast or just want to manage your finances better, these apps have got you covered.

Let’s be real, life can throw some curveballs when you least expect it. Maybe your car broke down, or you’ve got an unexpected bill staring you in the face. Whatever the reason, waiting for payday can feel like forever. That’s where these apps come in handy. They’re designed to give you access to the money you’ve already earned, so you don’t have to stress about borrowing from friends or family.

Now, before we dive into the nitty-gritty, let’s set one thing straight. Not all apps are created equal. Some are legit, while others might leave you worse off than when you started. So, buckle up as we explore the best apps for money before payday, how they work, and why you should consider them. By the end of this article, you’ll know exactly which app suits your needs and how to use it like a pro.

Read also:Trophy Club Power Outage What You Need To Know And How To Prepare

Here’s a quick overview of what we’ll cover:

- What are apps for money before payday?

- How do these apps work?

- Top 10 apps for money before payday

- Pros and cons of using these apps

- Tips for managing your finances better

- Final thoughts and next steps

What Are Apps for Money Before Payday?

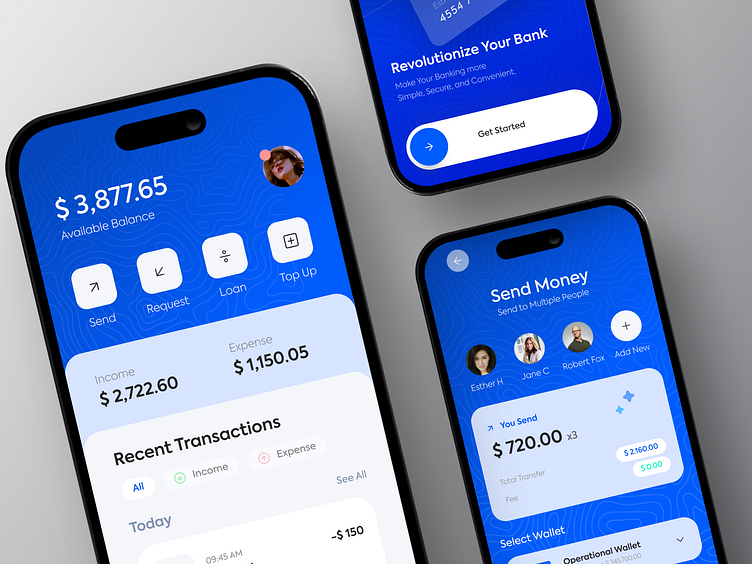

Let’s start with the basics, shall we? Apps for money before payday are digital platforms that allow you to access a portion of your earned wages before your official payday. Think of it as an advance on your paycheck, but without the hassle of traditional loans. These apps work by partnering with employers or using payroll data to verify your earnings, ensuring you only get the money you’ve already worked for.

Here’s the kicker—most of these apps don’t charge interest, which makes them a much better option than payday loans. Instead, they might charge a small fee or offer the service for free, depending on the app. It’s like having a financial safety net in your pocket, ready to catch you when life gets a little rocky.

Now, you might be wondering, "How do I even start using one of these apps?" Don’t worry, we’ll get into that in a bit. But first, let’s talk about why these apps are becoming so popular.

Why Are These Apps So Popular?

Let’s face it, life has changed a lot over the years, and so have our financial needs. More and more people are turning to apps for money before payday because they offer a convenient and stress-free way to manage cash flow. Unlike traditional loans, these apps don’t require lengthy applications, credit checks, or mountains of paperwork. All you need is a smartphone and a steady job, and you’re good to go.

Another reason these apps are gaining traction is their flexibility. Most of them allow you to withdraw small amounts of money whenever you need it, without having to repay everything at once. This makes them perfect for covering unexpected expenses or just keeping your budget in check.

Read also:Spartanburg Obits A Journey Through The Lives Remembered

But wait, there’s more! Some of these apps also come with additional features like budgeting tools, savings accounts, and financial education resources. It’s like having a personal finance coach in your pocket, helping you make smarter money decisions.

How Do These Apps Work?

Alright, so you’re probably wondering how these apps actually work. Let me break it down for you. First, you’ll need to download the app and create an account. During the signup process, you’ll be asked to link your employer or payroll provider to verify your earnings. This step is crucial because it ensures the app knows how much money you’ve earned and how much you can withdraw.

Once your account is set up, you can request an advance on your paycheck whenever you need it. The app will then transfer the money directly to your bank account, usually within a few minutes or hours. Some apps even offer instant transfers for a small fee, which is perfect if you’re in a bind.

When payday rolls around, the app will automatically deduct the amount you withdrew, plus any applicable fees, from your paycheck. It’s a simple, seamless process that takes the guesswork out of managing your finances.

Common Features of These Apps

Now that you know how these apps work, let’s take a closer look at some of their most common features:

- Paycheck Advance: Access a portion of your earned wages before payday.

- Budgeting Tools: Track your expenses and manage your money more effectively.

- Savings Accounts: Set aside money for emergencies or future goals.

- Financial Education: Learn tips and tricks for improving your financial health.

- No Credit Checks: Most apps don’t require a credit check, making them accessible to everyone.

As you can see, these apps offer a lot more than just quick cash. They’re designed to help you build better financial habits and take control of your money.

Top 10 Apps for Money Before Payday

Now that you know what these apps are and how they work, let’s talk about the best ones out there. Here’s a list of the top 10 apps for money before payday, along with their key features and benefits:

1. Earnin

Earnin is one of the most popular apps for money before payday, and for good reason. It allows you to access up to $100 of your earned wages at any time, with no interest or hidden fees. Instead, the app encourages users to pay what they feel is fair through optional "tips." Earnin also offers a cashback card and budgeting tools to help you stay on top of your finances.

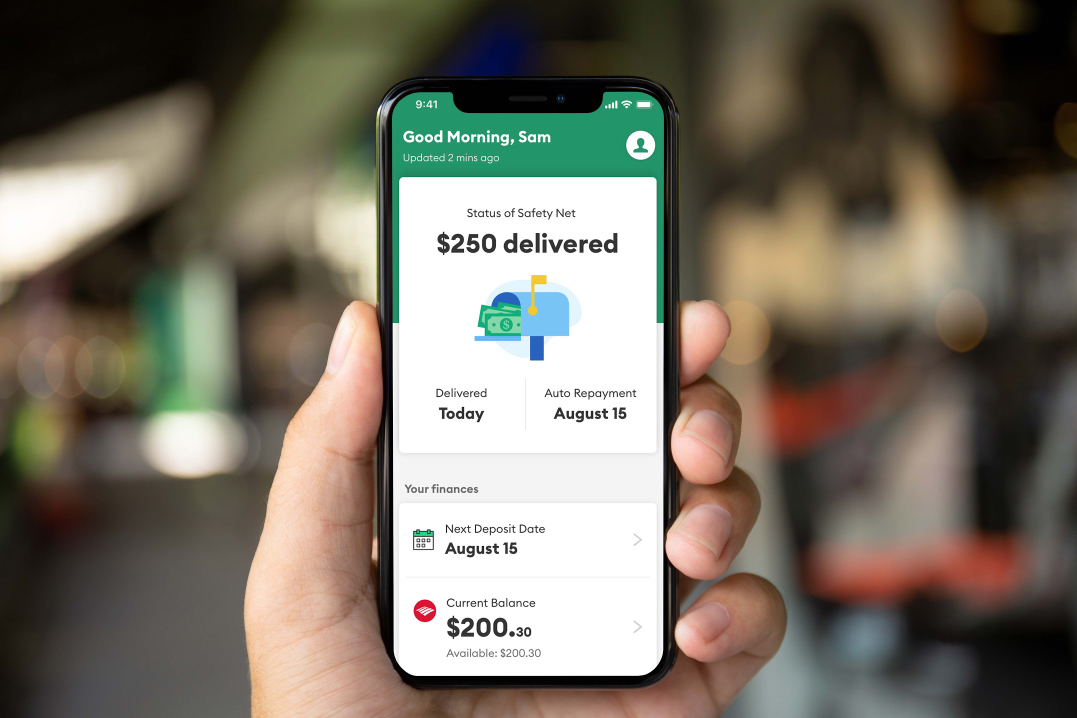

2. Dave

Dave is another great option if you’re looking for an app that offers more than just paycheck advances. In addition to letting you access up to $100 of your earned wages, Dave also provides a savings account, budgeting tools, and financial education resources. Plus, it offers a $1 million accidental death and dismemberment insurance policy for free!

3. Brigit

Brigit is an app that combines paycheck advances with budgeting tools and financial education. It allows you to access up to $500 of your earned wages, depending on your creditworthiness, and offers a savings account to help you build an emergency fund. Brigit also provides personalized financial advice to help you make smarter money decisions.

4. PayActiv

PayActiv is an app that partners with employers to offer paycheck advances and other financial services to employees. It allows you to access up to $500 of your earned wages, depending on your employer’s policy, and offers a variety of financial tools like budgeting, savings, and bill payment. PayActiv also provides access to financial counselors who can help you with debt management and credit building.

5. Activehours

Activehours is an app that lets you access up to $1,000 of your earned wages at any time, with no interest or hidden fees. Instead, the app encourages users to pay what they feel is fair through optional "tips." Activehours also offers a cashback card and budgeting tools to help you manage your money more effectively.

6. Even

Even is an app that helps you smooth out your income and expenses by offering paycheck advances and other financial tools. It allows you to access up to $500 of your earned wages, depending on your creditworthiness, and offers a savings account to help you build an emergency fund. Even also provides personalized financial advice to help you make smarter money decisions.

7. Salaryfi

Salaryfi is an app that offers paycheck advances and other financial services to employees. It allows you to access up to $500 of your earned wages, depending on your employer’s policy, and offers a variety of financial tools like budgeting, savings, and bill payment. Salaryfi also provides access to financial counselors who can help you with debt management and credit building.

8. HoneyBee

HoneyBee is an app that offers paycheck advances and other financial services to employees. It allows you to access up to $1,000 of your earned wages, depending on your creditworthiness, and offers a savings account to help you build an emergency fund. HoneyBee also provides personalized financial advice to help you make smarter money decisions.

9. PayCycle

PayCycle is an app that offers paycheck advances and other financial services to employees. It allows you to access up to $500 of your earned wages, depending on your employer’s policy, and offers a variety of financial tools like budgeting, savings, and bill payment. PayCycle also provides access to financial counselors who can help you with debt management and credit building.

10. DailyPay

DailyPay is an app that offers paycheck advances and other financial services to employees. It allows you to access up to $500 of your earned wages, depending on your employer’s policy, and offers a variety of financial tools like budgeting, savings, and bill payment. DailyPay also provides access to financial counselors who can help you with debt management and credit building.

Pros and Cons of Using Apps for Money Before Payday

Now that you know about some of the best apps for money before payday, let’s talk about the pros and cons of using them. Here’s a quick rundown:

Pros

- Quick access to cash when you need it most

- No interest or hidden fees (for most apps)

- Flexible repayment terms

- Additional features like budgeting tools and savings accounts

- No credit checks required

Cons

- Small withdrawal limits (usually $100-$500)

- Some apps charge fees for instant transfers

- Dependent on employer or payroll provider integration

- Potential for overspending if not used responsibly

As you can see, these apps have a lot of benefits, but they’re not without their drawbacks. It’s important to weigh the pros and cons before deciding which app is right for you.

Tips for Managing Your Finances Better

While apps for money before payday can be a lifesaver in tough times, they’re not a substitute for good financial habits. Here are a few tips to help you manage your money better:

- Create a budget and stick to it

- Build an emergency fund to cover unexpected expenses

- Pay off high-interest debt as soon as possible

- Set financial goals and track your progress

- Use budgeting apps to stay on top of your expenses

By following these tips, you can reduce your reliance on paycheck advances and build a more stable financial future.

Final Thoughts and Next Steps

There you have it, folks! Apps for money before payday can be a game-changer when it comes to managing your finances. They offer quick access to cash when you need it most, without the hassle of traditional loans. However, it’s important to use them responsibly and in conjunction with good financial habits.

So, what’s next? If you’re ready to take the plunge, start by researching the apps we’ve mentioned and finding the one that best suits your needs. Once you’ve chosen an app, download it, create an account, and start using it to manage your money more effectively.

And don’t forget to share this article with your friends and family! Who knows, you might just help someone else avoid the stress of waiting for payday. Remember, knowledge is power, and the more we share, the better off we all are.

Article Recommendations