App To Borrow Money Until Payday: Your Ultimate Guide To Financial Relief

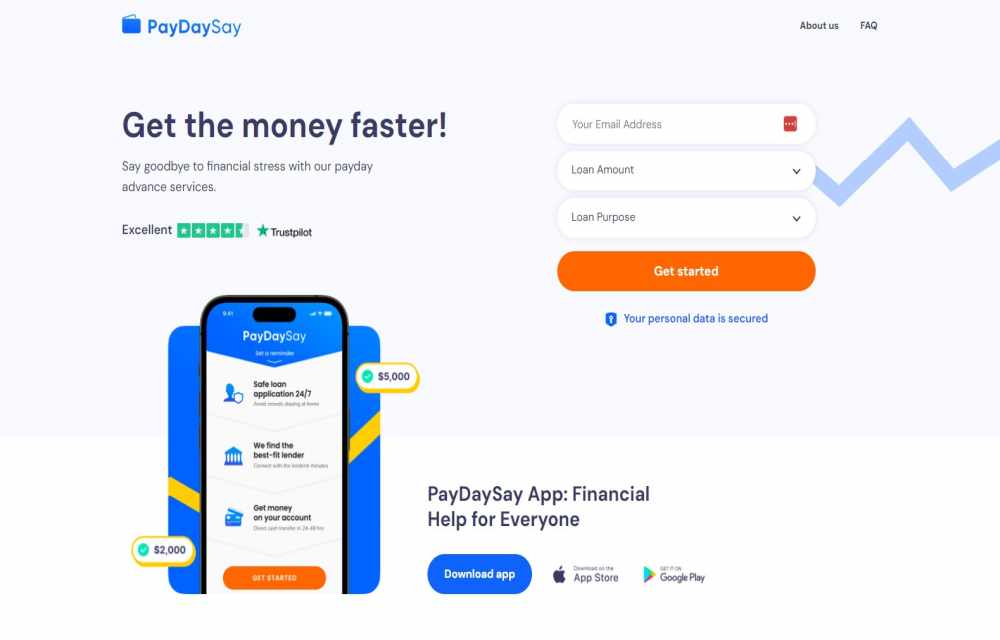

So, you're here because you're looking for an app to borrow money until payday, right? Let's face it, life can throw curveballs when you least expect it. Whether it's an unexpected car repair, a medical bill, or just trying to make ends meet before your next paycheck, having access to quick cash can be a lifesaver. But not all apps are created equal, and that's where we come in. In this article, we'll break down everything you need to know about borrowing money through apps, helping you make the right choice without getting lost in the fine print.

When it comes to financial emergencies, waiting for payday feels like an eternity. That’s why apps designed to lend you money until your next paycheck have become incredibly popular. These apps offer convenience, speed, and often lower interest rates compared to traditional payday loans. But how do they work, and which ones are trustworthy? Stick around, because we’re about to dive deep into the world of short-term borrowing apps so you can make an informed decision.

This isn’t just another article listing apps; we’re going to give you the inside scoop on what works, what doesn’t, and how to avoid falling into common traps. Think of us as your financial buddy, here to guide you through the maze of payday lending apps. Ready? Let’s get started!

Read also:A321 Seats Map Your Ultimate Guide To Comfort And Convenience

What Are Payday Loan Apps?

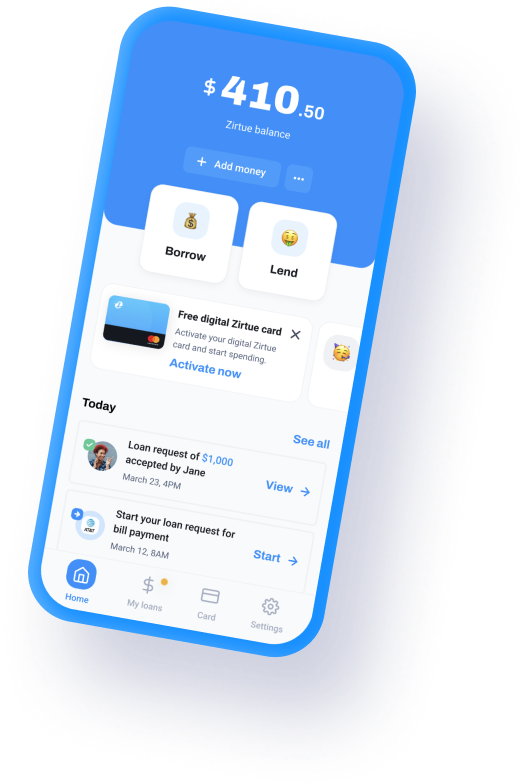

Payday loan apps are basically digital platforms that allow you to borrow small amounts of money to tide you over until your next paycheck. Unlike traditional payday loans, which often come with sky-high interest rates, these apps aim to provide a more user-friendly and affordable solution. They cater to people who need quick cash but don’t want to get stuck in a debt cycle. Most apps offer loans ranging from $100 to $1,000, depending on your income and creditworthiness.

Here’s the kicker: payday loan apps aren’t just for people with perfect credit. Many of them focus on accessibility, meaning even if you have less-than-stellar credit, you might still qualify for a loan. However, it’s important to read the terms and conditions carefully to ensure you’re not signing up for something you can’t afford to repay.

Why Choose an App to Borrow Money Until Payday?

There are plenty of reasons why people turn to payday loan apps when they’re in a financial pinch. First off, they’re incredibly convenient. You can apply from the comfort of your own home, often getting approved within minutes. Plus, most apps transfer funds directly to your bank account, sometimes even the same day. Here’s a quick rundown of the top benefits:

- Fast approval process – no waiting in line at a bank

- Flexible repayment options tailored to your payday schedule

- No hassle with paperwork – everything is done digitally

- Often lower fees compared to traditional payday loans

Of course, convenience comes with responsibility. It’s crucial to only borrow what you can realistically pay back to avoid falling into a debt spiral. These apps should be a tool for short-term relief, not a long-term solution to financial problems.

Top 10 Payday Loan Apps You Need to Know

Now that you understand the basics, let’s talk about some of the best apps out there for borrowing money until payday. Each app has its own unique features, so it’s important to choose one that fits your specific needs. Here’s our list of the top contenders:

1. Cash App

Cash App is more than just a payment platform; it also offers a feature called “Paycheck Advance,” allowing users to access up to $200 of their already earned wages. It’s a great option for those who use Cash App regularly and want a quick cash boost without high fees.

Read also:Wrath Cookie The Ultimate Cookie Clicker Strategy Guide

2. Dave

Dave is all about helping you avoid overdraft fees and providing small cash advances. Members can borrow up to $100 without interest, making it a solid choice for emergency funds. Plus, the app offers financial education tools to help you improve your money management skills.

3. Earnin

Earnin lets you access your earned wages whenever you need them, with no interest or hidden fees. It’s a pay-as-you-go model, meaning you only pay if you choose to tip the app for its services. If you’re looking for a completely transparent borrowing experience, Earnin might be the way to go.

4. Brigit

Brigit offers cash advances of up to $500, along with a budgeting tool to help you manage your finances better. The app charges a one-time fee for each advance, but it’s generally lower than traditional payday loan fees.

5. Salaryfinance

Salaryfinance works directly with employers to offer employees early access to their wages. It’s a great option if your company partners with the platform, as it eliminates the need for third-party lenders altogether.

6. Chime

Chime is a banking app that offers a “SpotMe” feature, allowing users to access up to $200 for free until their next paycheck. It’s a great option for those who want a combination of banking and borrowing services in one place.

7. Zeta

Zeta is designed specifically for gig workers, offering them instant access to their earnings. If you’re part of the gig economy, this app could be a game-changer for managing your cash flow.

8. PayActiv

PayActiv provides on-demand access to earned wages, along with financial wellness tools. It charges a small fee for each transaction, but many users find the convenience worth it.

9. Even

Even helps smooth out your income by offering cash advances and budgeting tools. It’s particularly useful for those with irregular pay schedules, such as freelancers or hourly workers.

10. HoneyBee

HoneyBee connects borrowers with lenders offering low-interest personal loans. While not a traditional payday loan app, it’s a great option for those looking for slightly larger amounts of money at competitive rates.

How Do Payday Loan Apps Work?

So, how exactly do these apps work? Most follow a similar process:

- Sign Up: Download the app and create an account. You’ll typically need to provide some personal information, including your bank account details and employment information.

- Verify Income: The app will verify your income to determine how much you can borrow. This might involve linking your bank account or providing pay stubs.

- Apply for a Loan: Once verified, you can apply for a loan. The app will review your application and let you know if you’re approved.

- Receive Funds: If approved, the funds will be deposited into your bank account, often within a few hours or by the next business day.

- Repay the Loan: Repayment is usually automated, with the app deducting the amount owed from your next paycheck.

It’s worth noting that while the process is generally straightforward, each app may have its own specific requirements and procedures. Always read the fine print to avoid any surprises.

Pros and Cons of Using Payday Loan Apps

Like anything, payday loan apps come with their own set of pros and cons. Here’s a quick breakdown to help you weigh your options:

Pros:

- Quick access to cash

- Flexible repayment terms

- No credit checks in some cases

- Convenient digital application process

Cons:

- Potential for high fees or interest rates

- Risk of falling into a debt cycle if not managed properly

- Not all apps are trustworthy – some may have hidden fees

While payday loan apps can be a lifesaver in emergencies, it’s important to use them responsibly. Always make sure you have a plan in place to repay the loan on time.

What to Look for in a Payday Loan App

Not all payday loan apps are created equal, so it’s important to do your research before choosing one. Here are some key factors to consider:

- Reputation: Look for apps with positive reviews and a track record of reliability.

- Fees: Check the fees and interest rates carefully to ensure they’re within your budget.

- Loan Amount: Make sure the app offers the amount you need – some only provide small advances, while others offer larger loans.

- Repayment Terms: Ensure the repayment schedule works with your payday schedule to avoid late fees.

- Security: Verify that the app uses secure encryption to protect your personal and financial information.

By taking the time to evaluate these factors, you can find an app that meets your needs without putting you at risk.

Common Pitfalls to Avoid

While payday loan apps can be incredibly helpful, they’re not without their pitfalls. Here are some common mistakes to avoid:

- Borrowing more than you can afford to repay

- Ignoring hidden fees or unclear terms and conditions

- Using payday loans as a long-term solution to financial problems

- Signing up for multiple apps at once, which can lead to confusion and missed payments

Remember, these apps should be used as a short-term solution, not a long-term crutch. If you find yourself relying on them too often, it might be time to reassess your financial situation and seek additional support.

Tips for Responsible Borrowing

Using a payday loan app responsibly is key to avoiding financial trouble down the line. Here are some tips to keep in mind:

- Create a Budget: Before borrowing, make a detailed budget to ensure you can repay the loan on time.

- Shop Around: Don’t settle for the first app you find – compare fees and terms to get the best deal.

- Set Reminders: Use calendar alerts or app notifications to remind yourself of repayment dates.

- Build an Emergency Fund: Once you’ve paid off the loan, start setting aside money for future emergencies to reduce your reliance on borrowing.

By following these tips, you can use payday loan apps as a tool for short-term relief without jeopardizing your long-term financial health.

Conclusion

In conclusion, an app to borrow money until payday can be a valuable resource when you’re facing a financial emergency. However, it’s important to choose the right app and use it responsibly to avoid falling into a debt cycle. By doing your research, comparing options, and following responsible borrowing practices, you can make the most of these apps while keeping your financial future secure.

We encourage you to share your thoughts and experiences in the comments below. Have you used any of these apps? What worked for you, and what didn’t? And don’t forget to check out our other articles for more tips on managing your finances like a pro. Until next time, stay financially savvy!

Table of Contents

Article Recommendations