Borrow Money Until Payday App: Your Ultimate Guide To Quick Cash Solutions

Need cash fast? Borrow money until payday apps might just be your lifesaver. In today's fast-paced world, unexpected expenses can pop up anytime, leaving you scrambling for quick financial solutions. Thankfully, technology has stepped in with apps designed to help you borrow money until payday without the hassle of traditional loans. These apps offer convenience, speed, and flexibility, making them a popular choice for people in need of immediate cash.

Imagine this: your car breaks down, or you have an urgent medical bill to pay, but payday is still a week away. What do you do? In the past, you might've turned to friends, family, or even high-interest payday loans. But now, there's a smarter way. Borrow money until payday apps provide a seamless solution to bridge the gap between your current financial situation and your next paycheck.

With so many options available, it's essential to know which apps are reliable and how they work. In this guide, we'll break down everything you need to know about borrow money until payday apps, including how they operate, their benefits, potential drawbacks, and tips to choose the right one for you. Let's dive in!

Read also:Wspy News Your Ultimate Source For Breaking Stories And Reliable Updates

What Are Borrow Money Until Payday Apps?

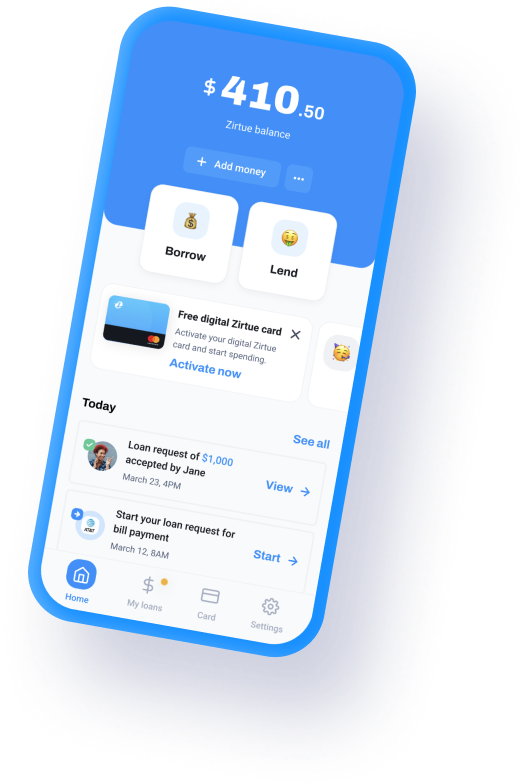

So, what exactly are borrow money until payday apps? Simply put, these are digital platforms that allow you to borrow a small amount of money to tide you over until your next paycheck. They're often referred to as payday loan apps or cash advance apps. Unlike traditional loans, these apps focus on providing quick access to cash without the lengthy application process or extensive credit checks.

Most borrow money until payday apps work by connecting you with lenders or offering their own funding options. You fill out a short application form, provide proof of income, and within minutes, you could have cash in your bank account. The amounts typically range from $100 to $1,000, depending on the app and your financial situation. Once you receive your paycheck, you repay the loan, usually with a small fee or interest.

How Do These Apps Work?

Here's a step-by-step breakdown of how borrow money until payday apps work:

- Download and Sign Up: Start by downloading the app from your app store and creating an account. This usually involves providing basic personal information.

- Provide Proof of Income: You'll need to verify your income, often by linking your bank account or uploading recent pay stubs.

- Apply for a Loan: Once your account is set up, you can apply for the amount you need. The app will review your application, usually within minutes.

- Receive Your Cash: If approved, the funds are typically deposited into your bank account within a day or two.

- Repay the Loan: On your next payday, the app will automatically withdraw the loan amount plus any fees from your account.

It's a pretty straightforward process, making it ideal for those who need quick cash without the stress of a long approval process.

Benefits of Borrow Money Until Payday Apps

There are plenty of reasons why borrow money until payday apps have become so popular. Here are some of the top benefits:

1. Quick Access to Cash

One of the biggest advantages is the speed at which you can access funds. Most apps promise to get cash into your account within 24 hours, sometimes even faster. This is perfect for emergencies where time is of the essence.

Read also:A321 Seats Map Your Ultimate Guide To Comfort And Convenience

2. No Credit Check

Many borrow money until payday apps don't require a traditional credit check. Instead, they focus on your ability to repay based on your income. This makes them accessible to people with poor credit scores who might struggle to get approved for traditional loans.

3. Convenience

Gone are the days of visiting a physical loan office. With these apps, everything is done digitally, from applying for a loan to repaying it. You can manage everything from your smartphone, making it incredibly convenient.

4. Small Loan Amounts

Unlike traditional loans that often come with high minimums, borrow money until payday apps offer smaller loan amounts. This is ideal for people who only need a small sum to cover unexpected expenses.

Potential Drawbacks of Borrow Money Until Payday Apps

While borrow money until payday apps offer many advantages, it's important to be aware of the potential drawbacks:

1. High Fees

Although the loan amounts are small, the fees can add up quickly. Some apps charge high interest rates or fees that make the loan more expensive than it seems at first glance. Always read the fine print before signing up.

2. Risk of Debt Cycle

Using these apps too frequently can lead to a cycle of debt. If you constantly rely on them to cover expenses, you might find yourself in a situation where you're borrowing to repay previous loans. It's crucial to use them responsibly and only when necessary.

3. Limited Loan Amounts

While the small loan amounts are convenient, they might not be enough to cover larger expenses. If you need a significant sum of money, you might have to explore other options.

Top Borrow Money Until Payday Apps

There are several reputable borrow money until payday apps available. Here are some of the top ones:

1. Cash App

Cash App is more than just a payment app; it also offers a cash advance feature called "Cash Boost." This allows users to get paid early for a small fee. It's a great option for those already using Cash App for their financial transactions.

2. Earnin

Earnin is unique because it offers interest-free cash advances. You can access your earned wages before payday without paying any fees. However, they do accept "tips" as a way to support the service.

3. Dave

Dave offers a cash advance feature that allows users to get up to $100 without any interest. They do charge a small monthly subscription fee, but it's often less than the fees charged by traditional payday loans.

4. PayActiv

PayActiv is an app that partners with employers to offer employees access to their earned wages early. It's a great option if your employer is already partnered with the service.

How to Choose the Right App for You

With so many options available, choosing the right borrow money until payday app can be overwhelming. Here are some factors to consider:

- Loan Amount: Consider how much you need and whether the app offers the amount you require.

- Fees and Interest Rates: Compare the fees and interest rates of different apps to ensure you're getting the best deal.

- Reputation: Look for reviews and ratings to gauge the reliability of the app.

- User Experience: Choose an app with a user-friendly interface that makes managing your finances easy.

Tips for Responsible Borrowing

Borrowing money until payday can be a lifesaver, but it's important to do so responsibly. Here are some tips to keep in mind:

1. Borrow Only What You Need

Resist the temptation to borrow more than necessary. Stick to the amount you need to cover your immediate expenses.

2. Repay on Time

Make sure you have enough money in your account on payday to repay the loan. Missing a payment can lead to additional fees and penalties.

3. Avoid Frequent Use

Try not to rely on borrow money until payday apps too often. Use them as a last resort for emergencies, not as a regular source of income.

Understanding the Costs

Before you borrow money through one of these apps, it's crucial to understand the costs involved. Here's a breakdown:

1. Interest Rates

Some apps charge interest on the loan amount, which can vary depending on the app and the loan size. Always check the interest rate before signing up.

2. Service Fees

Many apps charge a service fee for processing the loan. These fees can range from a few dollars to a percentage of the loan amount.

3. Late Payment Fees

If you miss a payment, you might incur late payment fees. These can add up quickly, so it's important to repay on time.

Alternatives to Borrow Money Until Payday Apps

While borrow money until payday apps are convenient, they're not the only option. Here are some alternatives to consider:

1. Personal Loans

If you need a larger sum of money, a personal loan might be a better option. They often come with lower interest rates and longer repayment terms.

2. Credit Cards

Using a credit card for cash advances is another option, but be aware of the high fees and interest rates associated with this method.

3. Friends and Family

Sometimes, borrowing from friends or family can be a more cost-effective solution. Just make sure to set clear terms and repayment plans to avoid any misunderstandings.

Conclusion

Borrow money until payday apps offer a convenient and quick solution for those in need of immediate cash. They provide access to funds without the hassle of traditional loans and are accessible to people with poor credit scores. However, it's important to use them responsibly and be aware of the potential drawbacks, such as high fees and the risk of debt cycles.

When choosing a borrow money until payday app, consider factors like loan amount, fees, reputation, and user experience. Always read the terms and conditions carefully and only borrow what you need. And if possible, explore alternative options like personal loans or credit cards for larger expenses.

So, the next time you're in a financial bind, consider using a borrow money until payday app. Just remember to borrow wisely and repay on time. Share your thoughts or experiences in the comments below, and don't forget to check out our other articles for more financial tips and tricks!

Daftar Isi

- What Are Borrow Money Until Payday Apps?

- How Do These Apps Work?

- Benefits of Borrow Money Until Payday Apps

- Potential Drawbacks of Borrow Money Until Payday Apps

- Top Borrow Money Until Payday Apps

- How to Choose the Right App for You

- Tips for Responsible Borrowing

- Understanding the Costs

- Alternatives to Borrow Money Until Payday Apps

- Conclusion

Article Recommendations