Payday Loan Apps IPhone: The Ultimate Guide To Borrowing Smart

So, you're looking into payday loan apps for iPhone, huh? Well, let me tell you, this is a topic that's getting more and more attention these days. Whether you're in a tight spot or just want to know your options, understanding payday loan apps can be a lifesaver. But hold up, not all apps are created equal, and you don't wanna end up in a financial mess, right? So, let's dive in and break it down for you.

Imagine this: you've got a sudden car repair bill or maybe an unexpected medical expense, and your paycheck isn't coming in for another week. What do you do? Enter payday loan apps. These apps are designed to give you quick access to cash, but they come with their own set of rules and risks. It's like borrowing from a friend, but instead, it's an app on your iPhone.

Now, I know what you're thinking – "Are payday loan apps legit? Can they really help me out?" The answer is yes, but only if you know how to use them wisely. In this guide, we'll cover everything you need to know about payday loan apps for iPhone, from the best options to the potential pitfalls. Let's make sure you're making the right call when it comes to borrowing money.

Read also:Collier County Arrests Today Breaking Down The Latest Updates

What Are Payday Loan Apps?

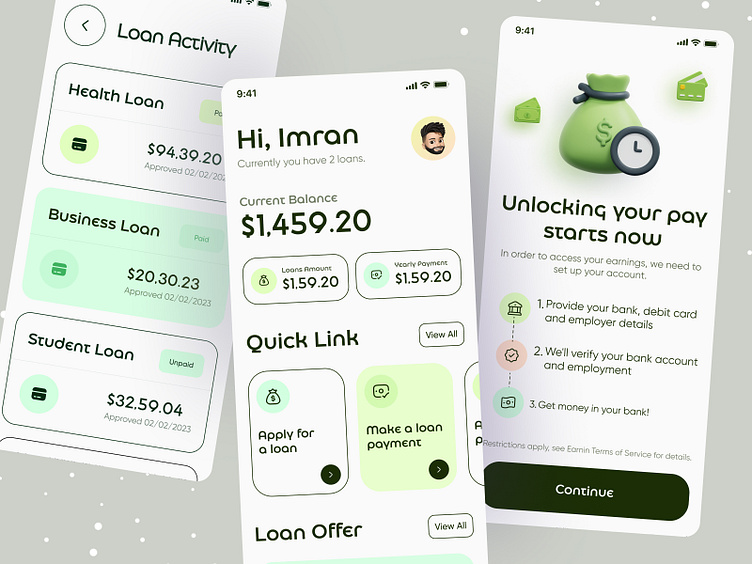

Payday loan apps are basically digital platforms that let you borrow small amounts of money quickly, often to cover short-term expenses. These apps are super convenient because you can apply right from your iPhone, and if approved, the money can be in your account within hours. Think of it like a mini loan that you'll pay back once you get your next paycheck.

Here's the deal, though: payday loans usually come with high interest rates and fees. If you don't pay them back on time, you could end up in a cycle of debt that's tough to break. But hey, when used responsibly, payday loan apps can be a great tool for managing unexpected expenses.

Why Use Payday Loan Apps for iPhone?

Let's face it – life can throw curveballs at you when you least expect it. That's where payday loan apps come in handy. Using your iPhone, you can apply for a loan in just a few minutes without having to step foot in a bank. Plus, most apps don't require a ton of paperwork or a lengthy credit check, making it accessible even for people with less-than-perfect credit scores.

Some key reasons why people turn to payday loan apps for iPhone include:

- Quick access to cash – no waiting around for approval.

- No need to visit a physical location – everything's done through your phone.

- Flexible repayment options – you can often choose how and when to pay back the loan.

- Simple application process – most apps only require basic info like your income and bank account details.

Best Payday Loan Apps for iPhone in 2023

Now that you know what payday loan apps are and why they're useful, let's talk about some of the best options out there. Not all apps are created equal, so it's important to do your research before signing up. Here are a few of the top contenders in 2023:

1. Cash App

Cash App isn't just for sending money to friends – it also offers a payday loan feature called "Cash Boost." With Cash Boost, you can get an advance on your paycheck for a small fee. The app integrates with your employer, so it knows when you're getting paid and automatically deducts the amount you borrowed plus the fee.

Read also:Score Big On Your Grocery Game With Publix Weekly Ad Bogo

2. Dave

Dave is another popular payday loan app that offers cash advances without charging interest. Instead, the app uses a subscription model, where you pay a monthly fee for access to features like cash advances and bill reminders. Dave also helps you build credit over time, which is a nice bonus.

3. Earnin

Earnin lets you access your earned wages before payday without charging any fees or interest. The app works by connecting to your employer and calculating how much you've earned so far. You can then withdraw that money instantly to your bank account. Earnin relies on optional tips from users to keep its services running.

How Do Payday Loan Apps Work?

Using a payday loan app is pretty straightforward. Here's a step-by-step breakdown of how it typically works:

- Download the app from the App Store and create an account.

- Provide some basic info, like your income, bank account details, and employment status.

- Apply for the loan amount you need – most apps cap the maximum amount you can borrow.

- Wait for approval – this usually happens within minutes.

- Receive the funds in your bank account – often within hours.

- Pay back the loan on your next payday – some apps automatically deduct the amount from your account.

It's important to read the terms and conditions carefully before applying. Some apps may charge hidden fees or have strict repayment schedules, so make sure you understand what you're getting into.

Benefits of Using Payday Loan Apps

Payday loan apps offer several advantages over traditional loans or credit cards. Here are a few benefits to consider:

- Speed: You can get approved and receive funds in as little as a few hours.

- Convenience: Everything is done through your iPhone, so no need to visit a bank or fill out stacks of paperwork.

- Accessibility: Many apps cater to people with bad credit or no credit history, making it easier to qualify for a loan.

- Flexibility: Some apps allow you to choose how much you want to borrow and how you'll repay it.

Of course, there are downsides too, which we'll cover in the next section. But for many people, the benefits outweigh the risks when used responsibly.

Potential Risks of Payday Loan Apps

While payday loan apps can be helpful in a pinch, they're not without their risks. Here are a few things to watch out for:

- High Interest Rates: Many payday loan apps charge exorbitant interest rates, which can make it hard to pay back the loan on time.

- Hidden Fees: Some apps may charge additional fees that aren't clearly disclosed upfront.

- Debt Cycle: If you can't pay back the loan by your next payday, you might end up rolling it over into another loan, creating a cycle of debt.

- Scams: Unfortunately, there are plenty of fake payday loan apps out there that prey on unsuspecting users. Always do your research and stick to reputable platforms.

To avoid these risks, make sure you only borrow what you can afford to pay back and always read the fine print before signing up for a loan.

How to Choose the Right Payday Loan App

With so many payday loan apps available, how do you know which one to choose? Here are a few tips to help you make the right decision:

1. Check Reviews and Ratings

Before downloading any app, take a look at its reviews and ratings on the App Store. This will give you an idea of what other users think about the app's reliability and customer service.

2. Look for Transparency

A good payday loan app will clearly disclose all fees and interest rates upfront. Avoid apps that try to hide this information or make it difficult to find.

3. Consider Repayment Terms

Make sure the app offers repayment terms that work for you. Some apps require you to pay back the loan in full on your next payday, while others offer more flexible options.

4. Check for Security Features

Your financial information is sensitive, so it's important to choose an app that takes security seriously. Look for apps that use encryption and other security measures to protect your data.

Alternatives to Payday Loan Apps

If you're not comfortable using payday loan apps, there are other options available for getting quick access to cash. Here are a few alternatives to consider:

- Personal Loans: Traditional personal loans from banks or credit unions often come with lower interest rates than payday loans.

- Credit Cards: If you have a credit card with available credit, you can use it to cover short-term expenses.

- Friends and Family: Sometimes, borrowing from loved ones can be a better option than taking out a loan.

- Community Resources: Many communities offer assistance programs for people in financial need. Check out local charities or government programs for help.

Remember, payday loan apps aren't the only solution when you're in a financial bind. Take the time to explore all your options before making a decision.

Tips for Using Payday Loan Apps Responsibly

If you decide to use a payday loan app, here are a few tips to help you do it responsibly:

- Borrow Only What You Need: Don't take out a loan for more than you absolutely need – this will make it easier to pay back on time.

- Plan for Repayment: Make a plan for how you'll pay back the loan before you even apply. This will help you avoid falling into a debt cycle.

- Read the Fine Print: Always read the terms and conditions carefully to avoid unexpected fees or interest charges.

- Stick to Reputable Apps: Only use payday loan apps that are well-reviewed and have a proven track record of reliability.

By following these tips, you can minimize the risks associated with payday loan apps and make sure you're using them wisely.

Conclusion

Payday loan apps for iPhone can be a great resource when you're facing a financial emergency, but they're not without their risks. By doing your research, choosing a reputable app, and using it responsibly, you can avoid the pitfalls and get the help you need. Remember, these apps are meant to be a short-term solution, not a long-term financial strategy.

So, what's next? If you're considering using a payday loan app, take the time to explore your options and make an informed decision. And hey, if you found this guide helpful, don't forget to share it with your friends or leave a comment below. Let's keep the conversation going and help each other out when it comes to managing our finances!

Table of Contents

- What Are Payday Loan Apps?

- Why Use Payday Loan Apps for iPhone?

- Best Payday Loan Apps for iPhone in 2023

- Cash App

- Dave

- Earnin

- How Do Payday Loan Apps Work?

- Benefits of Using Payday Loan Apps

- Potential Risks of Payday Loan Apps

- How to Choose the Right Payday Loan App

- Alternatives to Payday Loan Apps

- Tips for Using Payday Loan Apps Responsibly

Article Recommendations